Bitcoin: Difference between revisions

Cryptowiki (talk | contribs) No edit summary |

Cryptowiki (talk | contribs) mNo edit summary |

||

| (4 intermediate revisions by the same user not shown) | |||

| Line 146: | Line 146: | ||

== History == | == History == | ||

Bitcoin, often called ‘[https://www.tokenmetrics.com/blog/bitcoin-history digital gold]’, has transformed from a simple concept into a global financial revolution. Its significance reaches far beyond market trends or public debates.<sup>[https://www.tokenmetrics.com/blog/bitcoin-history 5]</sup> | Bitcoin, often called ‘[https://www.tokenmetrics.com/blog/bitcoin-history digital gold]’, has transformed from a simple concept into a global financial revolution. Its significance reaches far beyond market trends or public debates.<sup>[https://www.tokenmetrics.com/blog/bitcoin-history 5]</sup> | ||

Tracing Bitcoin’s evolution reveals more than just technological progress; it tells the story of society’s changing perception of money, trust, and value. From its mysterious creation to its worldwide influence, Bitcoin’s journey embodies innovation, resilience, and the future of decentralized finance. | |||

<small><sup>1</sup> BBC, “What is Bitcoin? An eight-step guide to cryptocurrency”, [https://www.bbc.co.uk/bitesize/articles/zfsvy9q Achieved] referred to as ‘digital gold,’ has evolved Retrieved July 2020.</small> | <small><sup>1</sup> BBC, “What is Bitcoin? An eight-step guide to cryptocurrency”, [https://www.bbc.co.uk/bitesize/articles/zfsvy9q Achieved] referred to as ‘digital gold,’ has evolved Retrieved July 2020.</small> | ||

| Line 156: | Line 158: | ||

<small><sup>5</sup> Token Metrics, “ The History of Bitcoin - A Journey from Ideology to Adoption”, [https://www.tokenmetrics.com/blog/bitcoin-history Achieved]</small> | <small><sup>5</sup> Token Metrics, “ The History of Bitcoin - A Journey from Ideology to Adoption”, [https://www.tokenmetrics.com/blog/bitcoin-history Achieved]</small> | ||

== Background == | == Background == | ||

| Line 167: | Line 167: | ||

In 2004, [https://koinly.io/blog/hal-finney-bitcoin/ Hal Finney] developed [https://nakamotoinstitute.org/finney/rpow/ RPOW (Reusable Proof of Work)] to facilitate the exchange of proof-of-work tokens. Its novel design served mainly as a proof of concept rather than a | In 2004, [https://koinly.io/blog/hal-finney-bitcoin/ Hal Finney] developed [https://nakamotoinstitute.org/finney/rpow/ RPOW (Reusable Proof of Work)] to facilitate the exchange of proof-of-work tokens. Its novel design served mainly as a proof of concept rather than a | ||

mainstream currency. [https://www.paypal.com/in/home PayPal], initially envisioned in the late 1990s as a global digital currency, faced regulatory and practical obstacles and instead evolved into the widely used online payment platform. Collectively, these early efforts, despite challenges or incomplete implementation, laid the groundwork for Bitcoin and the broader ecosystem of decentralized digital currencies. | |||

<small><sup>6</sup> Blockpitt, “Bitcoin’s History & Evolution: From Cypherpunks to Cryptographic Milestones, [https://www.blockpit.io/blog/bitcoin-history-evolution Achieved], Retrieved March 2025.</small> | <small><sup>6</sup> Blockpitt, “Bitcoin’s History & Evolution: From Cypherpunks to Cryptographic Milestones, [https://www.blockpit.io/blog/bitcoin-history-evolution Achieved], Retrieved March 2025.</small> | ||

| Line 175: | Line 177: | ||

<small><sup>9</sup> Atlas21, “E-gold: the story of the first digital currency backed by gold” [https://atlas21.com/e-gold-the-story-of-the-first-digital-currency-backed-by-gold/ Achieved], Retrieved November 2024</small> | <small><sup>9</sup> Atlas21, “E-gold: the story of the first digital currency backed by gold” [https://atlas21.com/e-gold-the-story-of-the-first-digital-currency-backed-by-gold/ Achieved], Retrieved November 2024</small> | ||

== 2008–2009: Creation == | == 2008–2009: Creation == | ||

| Line 189: | Line 189: | ||

Bitcoin’s value initially remained near zero, doubling to $0.20 in October 2010 and reaching $0.30 by year-end. In 2011, [https://money.usnews.com/investing/articles/the-history-of-bitcoin Bitcoin exceeded $1], drawing attention from investors and speculators, experiencing its first significant price bubble and correction, events that ultimately reinforced its reputation for resilience and market potential. <sup>[https://money.usnews.com/investing/articles/the-history-of-bitcoin 12]</sup> | Bitcoin’s value initially remained near zero, doubling to $0.20 in October 2010 and reaching $0.30 by year-end. In 2011, [https://money.usnews.com/investing/articles/the-history-of-bitcoin Bitcoin exceeded $1], drawing attention from investors and speculators, experiencing its first significant price bubble and correction, events that ultimately reinforced its reputation for resilience and market potential. <sup>[https://money.usnews.com/investing/articles/the-history-of-bitcoin 12]</sup> | ||

Bitcoin closed 2011 at approximately $5.20, reflecting early volatility characteristic of emerging cryptocurrency markets. In 2012, Bitcoin experienced modest growth, remaining relatively stable compared with the more dramatic price movements in later years. In November 2012, the first [https://www.coinbase.com/en-in/learn/crypto-basics/what-is-a-bitcoin-halving Bitcoin halving] event set the stage for subsequent halving events.<sup>[https://www.kraken.com/learn/bitcoin-halving-history 13]</sup> | |||

<small><sup>10</sup> Investopedia, “Bitcoin's Price History” [https://www.investopedia.com/articles/forex/121815/bitcoins-price-history.asp Achieved], Retrieved October 2025</small> | <small><sup>10</sup> Investopedia, “Bitcoin's Price History” [https://www.investopedia.com/articles/forex/121815/bitcoins-price-history.asp Achieved], Retrieved October 2025</small> | ||

| Line 195: | Line 197: | ||

<small><sup>12</sup> U.S. News & World Report L.P, “The History of Bitcoin’’, [https://money.usnews.com/investing/articles/the-history-of-bitcoin Achieved], Retrieved September 2025</small> | <small><sup>12</sup> U.S. News & World Report L.P, “The History of Bitcoin’’, [https://money.usnews.com/investing/articles/the-history-of-bitcoin Achieved], Retrieved September 2025</small> | ||

== 2013–2014: First regulatory actions == | == 2013–2014: First regulatory actions == | ||

| Line 222: | Line 222: | ||

== 2015-2020: Growth, adoption, and market milestones == | == 2015-2020: Growth, adoption, and market milestones == | ||

By early 2015, Bitcoin prices had slumped, and skeptics predicted its end. However, the community regrouped, improving technology, wallets, and security behind the scenes. In 2015, Microsoft began accepting Bitcoin for Xbox and Windows software purchases, and the number of merchants accepting Bitcoin exceeded 100,000 worldwide. | By early 2015, Bitcoin prices had slumped, and skeptics predicted its end. However, the community regrouped, improving technology, wallets, and security behind the scenes. In 2015, [https://www.microsoft.com/en-in Microsoft] began accepting Bitcoin for [http://analyticsinsight.net/gaming/how-to-reset-your-xbox-to-factory-settings-quick-guide Xbox] and [https://www.analyticsinsight.net/tech-news/how-to-show-hidden-files-and-folders-in-windows-11 Windows] software purchases, and the number of merchants accepting Bitcoin exceeded 100,000 worldwide. | ||

In 2016, Japan officially recognized digital assets like Bitcoin as having functions similar to fiat currency, signaling growing regulatory acceptance. By July 2016, Bitcoin had marked its second halving event, reducing mining rewards from 25 BTC to 12.5 BTC per block, thereby tightening supply and influencing market dynamics. | In 2016, [https://www.sygna.io/zh-hant/blog/japan-crypto-regulation-history-2014-2020/ Japan officially] recognized digital assets like Bitcoin as having functions similar to [https://www.analyticsinsight.net/cryptocurrency-analytics-insight/what-is-fiat-currency-how-does-it-differ-from-crypto fiat currency,] signaling growing regulatory acceptance.<sup>[https://www.sygna.io/zh-hant/blog/japan-crypto-regulation-history-2014-2020/ 19]</sup> By July 2016, Bitcoin had marked its second halving event, reducing mining rewards from 25 BTC to 12.5 BTC per block, thereby tightening supply and influencing market dynamics. | ||

In November 2016, CME Group introduced the Bitcoin Reference Rate (BRR), providing a reliable, transparent daily benchmark for Bitcoin prices. | In November 2016, [https://www.cmegroup.com/ CME Group] introduced the Bitcoin Reference Rate (BRR), providing a reliable, transparent daily benchmark for Bitcoin prices.<sup>[https://www.investopedia.com/articles/forex/121815/bitcoins-price-history.asp 20]</sup> | ||

In 2017, Bitcoin’s price hovered around $1,000 before breaking $2,000 in mid-May and surging to $19,188 by December 16, attracting global investor attention. On August 1, 2017, a hard fork created Bitcoin Cash, a new blockchain designed to increase transaction capacity. | In 2017, Bitcoin’s price hovered around $1,000 before breaking $2,000 in mid-May and surging to $19,188 by December 16, attracting global investor attention. On August 1, 2017, a hard fork created Bitcoin Cash, a new blockchain designed to increase transaction capacity. | ||

In December 2017, the CME Group launched cash-settled Bitcoin futures, enabling investors to hedge their risk. The price reached a record high of $19,666 the following week. | In December 2017, the CME Group launched cash-settled [https://www.cmegroup.com/media-room/press-releases/2017/10/31/cme_group_announceslaunchofbitcoinfutures.html Bitcoin futures,] enabling investors to hedge their risk. The price reached a record high of $19,666 the following week. | ||

During 2018–2019, Bitcoin’s price stabilized with occasional spikes; for example, it surpassed $10,000 in June 2019, before closing around $6,612 in December. In May 2018, Bitcoin underwent its third halving, reducing mining rewards from 12.5 BTC to 6.25 BTC per block, further shaping market dynamics. | During 2018–2019, Bitcoin’s price stabilized with occasional spikes; for example, it surpassed $10,000 in June 2019, before closing around $6,612 in December. In May 2018, Bitcoin underwent its third halving, reducing mining rewards from 12.5 BTC to 6.25 BTC per block, further shaping market dynamics. | ||

In 2020, the economy shut down due to the COVID-19 pandemic. Bitcoin's price surged once again. The cryptocurrency opened the year at $7,161. The pandemic shutdown and | In 2020, the economy shut down due to the COVID-19 pandemic. Bitcoin's price surged once again. The [https://www.investopedia.com/terms/c/cryptocurrency.asp cryptocurrency] opened the year at $7,161. The pandemic shutdown and | ||

<small>18 CME Group Inc., “Celebrating Bitcoin’s 16th Birthday: A Look at Achievements in the Crypto Space”, Achieved, Retrieved January 2025.</small> | <small>18 CME Group Inc., “Celebrating Bitcoin’s 16th Birthday: A Look at Achievements in the Crypto Space”, [https://www.cmegroup.com/articles/2025/celebrating-bitcoins-16th-birthday-a-look-at-achievements-in-the-crypto-space.html Achieved], Retrieved January 2025.</small> | ||

<small>19 Sygna, “Japan’s History of Crypto Asset Regulation: 2014-2020” Achieved</small> | <small>19 Sygna, “Japan’s History of Crypto Asset Regulation: 2014-2020” [https://www.sygna.io/zh-hant/blog/japan-crypto-regulation-history-2014-2020/ Achieved]</small> | ||

<small>20 Investopedia, “Bitcoin's Price History” Achieved, Retrieved October 2025</small> | <small>20 Investopedia, “Bitcoin's Price History” [https://www.investopedia.com/articles/forex/121815/bitcoins-price-history.asp Achieved], Retrieved October 2025</small> | ||

subsequent government policies fueled investors' fears about the global economy, accelerating Bitcoin's rise. | subsequent government policies fueled investors' fears about the global economy, accelerating Bitcoin's rise. | ||

| Line 247: | Line 247: | ||

In 2021, Bitcoin broke its 2020 price record in less than a month, surpassing $40,000 by January 7. By mid-April 2021, Bitcoin reached an all-time high of $64,895 as companies and funds added it to their portfolios. | In 2021, Bitcoin broke its 2020 price record in less than a month, surpassing $40,000 by January 7. By mid-April 2021, Bitcoin reached an all-time high of $64,895 as companies and funds added it to their portfolios. | ||

Major firms, including Tesla and MicroStrategy, incorporated Bitcoin into their balance sheets, while ProShares launched the first U.S. Bitcoin futures ETF (BITO). | Major firms, including Tesla and [https://www.analyticsinsight.net/bitcoin/microstrategys-bitcoin-strategy-will-a-price-surge-raise-its-valuation MicroStrategy], incorporated Bitcoin into their balance sheets, while [https://www.analyticsinsight.net/cryptocurrency-analytics-insight/proshares-bitcoin-etf-records-nearly-1-5-billion-aum-while-inqubeta-qube-presale-passes-6-million ProShares] launched the first U.S. Bitcoin futures ETF (BITO).<sup>[https://www.oanda.com/us-en/trade-tap-blog/asset-classes/crypto/oanda-bitcoin-price-history-key-market-events-data-charts-insights-volatility/ 21]</sup> | ||

Payment platforms such as PayPal enabled users to buy, hold, and sell cryptocurrencies directly within their apps. | Payment platforms such as [https://www.paypal.com/ PayPal] enabled users to buy, hold, and sell cryptocurrencies directly within their apps.<sup>[https://money.usnews.com/investing/articles/the-history-of-bitcoin 22]</sup> | ||

By the summer of 2021, prices had fallen by 50%, closing at $30,829 on July 19, before rebounding to $52,956 in September and then dropping to $40,597. On November 10, 2021, Bitcoin reached $69,000, closing at $64,921, but fell to $46,211 by mid-December amid uncertainty from inflation and COVID-19 variants. | By the summer of 2021, prices had fallen by 50%, closing at $30,829 on July 19, before rebounding to $52,956 in September and then dropping to $40,597. On November 10, 2021, Bitcoin reached $69,000, closing at $64,921, but fell to $46,211 by mid-December amid uncertainty from inflation and COVID-19 variants. | ||

| Line 255: | Line 255: | ||

Between January and May 2022, Bitcoin’s price gradually declined, closing at $47,459 in March and falling below $30,000 by May 11. On June 13, 2022, crypto prices dropped below $23,000 for the first time since December 2020, and Bitcoin closed under $20,000 by year-end. | Between January and May 2022, Bitcoin’s price gradually declined, closing at $47,459 in March and falling below $30,000 by May 11. On June 13, 2022, crypto prices dropped below $23,000 for the first time since December 2020, and Bitcoin closed under $20,000 by year-end. | ||

In 2023, Bitcoin opened the year at $16,530 and rose consistently, ending the year at $42,258, reflecting renewed market strength. In 2022, FTX, the leading cryptocurrency exchange by trading volume, declared bankruptcy, marking a major market disruption. | In 2023, Bitcoin opened the year at $16,530 and rose consistently, ending the year at $42,258, reflecting renewed market strength. In 2022, FTX, the leading [https://www.analyticsinsight.net/cryptocurrency-analytics-insight/top-50-cryptocurrency-exchanges cryptocurrency exchange] by trading volume, declared bankruptcy, marking a major market disruption.<sup>[https://www.investopedia.com/articles/forex/121815/bitcoins-price-history.asp 23]</sup> | ||

<small>21 Oanda, “Bitcoin's price history (2009 - 2025) – key events and insights” Achieved, Retrieved June 2025</small> | <small>21 Oanda, “Bitcoin's price history (2009 - 2025) – key events and insights” [https://www.oanda.com/us-en/trade-tap-blog/asset-classes/crypto/oanda-bitcoin-price-history-key-market-events-data-charts-insights-volatility/ Achieved], Retrieved June 2025</small> | ||

<small>22 U.S. News & World Report L.P, “The History of Bitcoin’’, Achieved, Retrieved September 2025</small> | <small>22 U.S. News & World Report L.P, “The History of Bitcoin’’, [https://money.usnews.com/investing/articles/the-history-of-bitcoin Achieved], Retrieved September 2025</small> | ||

<small>23 Investopedia, “Bitcoin's Price History” Achieved, Retrieved October 2025</small> | <small>23 Investopedia, “Bitcoin's Price History” [https://www.investopedia.com/articles/forex/121815/bitcoins-price-history.asp Achieved], Retrieved October 2025</small> | ||

== 2024: Bitcoin Goes Mainstream with ETFs == | == 2024: Bitcoin Goes Mainstream with ETFs == | ||

In January 2024, the U.S. The Securities and Exchange Commission approved spot Bitcoin Exchange-Traded Products (ETFs), marking a historic financial milestone. For the first time, everyday investors could directly access Bitcoin through regulated products available on mainstream stock exchanges. | In January 2024, the [https://www.sec.gov/ U.S. The Securities and Exchange Commission] approved [https://www.investopedia.com/spot-bitcoin-etfs-8358373#:~:text=Spot%20Bitcoin%20ETFs%20provide%20a,a%20new%2C%20regulated%20investment%20option. spot Bitcoin] [https://www.investopedia.com/spot-bitcoin-etfs-8358373#:~:text=Spot%20Bitcoin%20ETFs%20provide%20a,a%20new%2C%20regulated%20investment%20option. Exchange-Traded Products (ETFs),] marking a historic financial milestone. For the first time, everyday investors could directly access Bitcoin through regulated products available on mainstream stock exchanges. | ||

The market reacted quickly, with prices climbing as cautious investors who had previously stayed on the sidelines joined the buying frenzy. ETFs made investing in Bitcoin more accessible for those familiar with stock trading, eliminating the need to navigate cryptocurrency wallets or exchanges. | The market reacted quickly, with prices climbing as cautious investors who had previously stayed on the sidelines joined the buying frenzy. ETFs made investing in Bitcoin more accessible for those familiar with stock trading, eliminating the need to navigate cryptocurrency [https://www.analyticsinsight.net/cryptocurrency-analytics-insight/top-10-crypto-wallets-for-secure-transactions wallets] or exchanges. | ||

While volatility persisted, the approval strengthened institutional access and signaled a deeper connection between Bitcoin and traditional finance. | While volatility persisted, the approval strengthened institutional access and signaled a deeper connection between Bitcoin and traditional finance.<sup>[https://www.oanda.com/us-en/trade-tap-blog/asset-classes/crypto/oanda-bitcoin-price-history-key-market-events-data-charts-insights-volatility/ 24]</sup> | ||

== 2025: Bitcoin Moves into Strategic Finance == | == 2025: Bitcoin Moves into Strategic Finance == | ||

In 2025, the GENIUS Act was signed into law by President Donald Trump, establishing regulatory standards for stablecoins and broader cryptocurrency markets. Additional legislation restricted central banks from issuing digital currencies while allowing for the integration of cryptocurrencies into retirement and investment plans. | In 2025, the [https://www.weforum.org/stories/2025/07/stablecoin-regulation-genius-act/ GENIUS Act] was signed into law by President Donald Trump, establishing regulatory standards for [https://www.analyticsinsight.net/cryptocurrency-analytics-insight/stablecoins-to-watch-10-picks-for-smarter-crypto-control-in-2025 stablecoins] and broader cryptocurrency markets. Additional legislation restricted [https://www.ecb.europa.eu/ecb-and-you/explainers/tell-me/html/what-is-a-central-bank.en.html central banks] from issuing digital currencies while allowing for the integration of cryptocurrencies into retirement and investment plans. | ||

An executive order created a strategic Bitcoin reserve, signaling growing recognition of Bitcoin as a key financial asset. By 2025, government-held Bitcoin reached over $20 billion, marking a significant milestone in institutional adoption and official endorsement. | An executive order created a [https://www.whitehouse.gov/presidential-actions/2025/03/establishment-of-the-strategic-bitcoin-reserve-and-united-states-digital-asset-stockpile/ strategic Bitcoin reserve], signaling growing recognition of Bitcoin as a key financial asset. By 2025, government-held Bitcoin reached over $20 billion, marking a significant milestone in institutional adoption and official endorsement.<sup>[https://money.usnews.com/investing/articles/the-history-of-bitcoin 25]</sup> | ||

In early 2025, Bitcoin traded above $110,000, exhibiting lower volatility compared to earlier years (daily standard deviation of ~2.1% vs. ~5.3% in 2021). It has entered mainstream | In early 2025, Bitcoin traded above $110,000, exhibiting lower volatility compared to earlier years (daily standard deviation of ~2.1% vs. ~5.3% in 2021). It has entered mainstream | ||

finance, included in investment portfolios, while regulators shape rules for institutional crypto exposure. | |||

< | Bitcoin’s history of extreme highs and drops demonstrates resilience and its ongoing influence on modern finance and digital asset adoption.<sup>[https://www.oanda.com/us-en/trade-tap-blog/asset-classes/crypto/oanda-bitcoin-price-history-key-market-events-data-charts-insights-volatility/ 26]</sup> | ||

<small><sup>24</sup> Oanda, “Bitcoin's price history (2009 - 2025) – key events and insights” [https://www.oanda.com/us-en/trade-tap-blog/asset-classes/crypto/oanda-bitcoin-price-history-key-market-events-data-charts-insights-volatility/ Achieved], Retrieved June 2025</small> | |||

<small><sup>25</sup> U.S. News & World Report L.P, “The History of Bitcoin’’, [https://money.usnews.com/investing/articles/the-history-of-bitcoin Achieved], Retrieved September 2025</small> | |||

= Bitcoin Design = | = Bitcoin Design = | ||

Bitcoin (BTC) is a digital currency with a highly divisible structure, designed to accommodate both large and small transactions. The standard unit of Bitcoin is the bitcoin (BTC), represented by the symbol ₿. | Bitcoin (BTC) is a [https://www.oanda.com/us-en/trade-tap-blog/asset-classes/crypto/oanda-bitcoin-price-history-key-market-events-data-charts-insights-volatility/ digital currency] with a highly divisible structure, designed to accommodate both large and small transactions. The standard unit of Bitcoin is the bitcoin (BTC), represented by the [https://www.compart.com/en/unicode/U+20BF symbol ₿.] | ||

Its units, such as BTC, mBTC, bits (μBTC), and satoshis, allow precise payments, while flexible formatting ensures wallets and applications display values clearly for users worldwide. | Its units, such as BTC, [https://bitflyer.com/en-eu/s/glossary/mbtc mBTC], [https://bitcoin.design/guide/designing-products/units-and-symbols/ bits] [https://bitcoin.design/guide/designing-products/units-and-symbols/ (μBTC)], and satoshis, allow precise payments, while flexible formatting ensures wallets and applications display values clearly for users worldwide. | ||

== Units, Symbol, and Divisibility == | == Units, Symbol, and Divisibility == | ||

| Line 318: | Line 316: | ||

|msat | |msat | ||

|0.00000000001 | |0.00000000001 | ||

|} | |}The satoshi (sat) is the smallest widely recognized unit, equivalent to one hundred millionth of a bitcoin. | ||

On the [https://www.investopedia.com/terms/l/lightning-network.asp Lightning Network], even smaller units such as [https://www.dnacrypto.co/what-is-a-milli-satoshi millisatoshi (msat)] are used for microtransactions. The Unicode symbol ₿ was formalized in June 2017, although typeface support remains limited. | |||

<small><sup>26</sup> Oanda, “Bitcoin's price history (2009 - 2025) – key events and insights” [https://www.oanda.com/us-en/trade-tap-blog/asset-classes/crypto/oanda-bitcoin-price-history-key-market-events-data-charts-insights-volatility/ Achieved], Retrieved June 2025</small> | |||

=== Divisibility === | === Divisibility === | ||

Bitcoin’s divisibility enables transactions in small amounts, providing flexibility for both everyday payments and large-scale transfers. This feature makes it practical for a wide range of financial activities, from microtransactions to high-value transfers. | [https://www.blog.bitfinity.network/understanding-bitcoins-divisibility-who-said-you-cant-split-a-bitcoin/ Bitcoin’s divisibility] enables transactions in small amounts, providing flexibility for both everyday payments and large-scale transfers. This feature makes it practical for a wide range of financial activities, from microtransactions to high-value transfers. | ||

By default, on-chain wallets show amounts in bitcoin with up to 8 decimal places, whereas Lightning Network wallets often display values in satoshis for easier handling of small payments. Users can typically choose their preferred unit depending on the context and settings within their application. | By default, on-chain wallets show amounts in bitcoin with up to 8 decimal places, whereas [https://simpleswap.io/blog/best-bitcoin-lightning-wallets Lightning Network wallets] often display values in satoshis for easier handling of small payments. Users can typically choose their preferred unit depending on the context and settings within their application. | ||

=== Formatting and Display === | === Formatting and Display === | ||

| Line 335: | Line 332: | ||

An alternative representation called the ₿-only format has been proposed to reduce user confusion. In this approach, quantities are represented as integers, denoting the number of base units (satoshis) that make up the total. The ₿ symbol is used to label all amounts, and decimal representation, as well as the explicit use of “sats,” are deprecated. | An alternative representation called the ₿-only format has been proposed to reduce user confusion. In this approach, quantities are represented as integers, denoting the number of base units (satoshis) that make up the total. The ₿ symbol is used to label all amounts, and decimal representation, as well as the explicit use of “sats,” are deprecated. | ||

For example, 0.00000100 BTC is displayed as ₿100, while 3.25 BTC becomes ₿325,000,000. This format has been adopted by several wallets, including Boardwalk Cash, Blitz Wallet, Bitkit, and Wallet of Satoshi, as of September 2025. | For example, 0.00000100 BTC is displayed as ₿100, while 3.25 BTC becomes ₿325,000,000. This format has been adopted by several wallets, including [https://boardwalkcash.com/ Boardwalk] Cash, [https://blitz-wallet.com/ Blitz Wallet], Bitkit, and [https://www.walletofsatoshi.com/ Wallet of Satoshi], as of September 2025. | ||

<small>27 Bitcoin Design Community, “Bitcoin Design”, Archived</small> | <small>27 Bitcoin Design Community, “Bitcoin Design”, [https://bitcoin.design/guide/designing-products/units-and-symbols/#:~:text=Current%20adoption%20%23,lightning%20network%20are%20sometimes%20used. Archived]</small> | ||

== Blockchain: Bitcoin’s Backbone == | == Blockchain: Bitcoin’s Backbone == | ||

Bitcoin operates without a central authority, allowing anyone to create addresses and transact freely. This is achieved via a distributed ledger called the blockchain, which records all bitcoin transactions. | Bitcoin operates without a central authority, allowing anyone to create addresses and transact freely. This is achieved via a distributed ledger called the [https://www.analyticsinsight.net/bitcoin/how-does-bitcoin-blockchain-work-explained-in-simple-terms blockchain], which records all bitcoin transactions. | ||

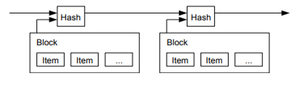

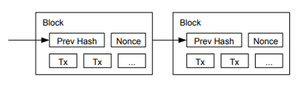

The blockchain is a chain of blocks, each with a header and a body. The body stores transactions, while the header contains metadata, including a SHA-256 hash of the previous block, which links blocks securely and makes tampering detectable. Mining adds new blocks by solving cryptographic puzzles, rewarding miners with bitcoins and transaction fees. | The blockchain is a chain of blocks, each with a header and a body. The body stores transactions, while the header contains metadata, including a SHA-256 hash of the previous block, which links blocks securely and makes tampering detectable. Mining adds new blocks by solving [https://www.pcmag.com/encyclopedia/term/crypto-puzzle cryptographic puzzles], rewarding miners with bitcoins and transaction fees. | ||

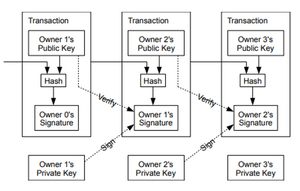

Cryptography secures transactions, creates digital signatures, ensures blockchain integrity, and preserves privacy. Users have a private key to sign transactions and a public key to receive bitcoins. Private keys must be securely stored, while public keys are derived via one-way functions. | [https://www.analyticsinsight.net/definition/cryptography Cryptography] secures transactions, creates digital signatures, ensures blockchain integrity, and preserves privacy. Users have a private key to sign transactions and a public key to receive bitcoins. [https://www.investopedia.com/terms/p/private-key.asp Private keys] must be securely stored, while public keys are derived via one-way functions. | ||

The Bitcoin network is a global system of nodes that validate, broadcast, and store the blockchain. Consensus is achieved through Proof of Work, ensuring secure, verified, and irreversible transactions. Transactions are initiated, signed, broadcast, validated, and finally confirmed when added to the blockchain. | The Bitcoin network is a global system of [https://builtin.com/blockchain/blockchain-node nodes] that validate, broadcast, and store the blockchain. Consensus is achieved through Proof of Work, ensuring secure, verified, and irreversible transactions. Transactions are initiated, signed, broadcast, validated, and finally confirmed when added to the blockchain.<sup>[https://www.blockpit.io/blog/how-does-bitcoin-work 28]</sup> | ||

== Addresses and transactions == | == Addresses and transactions == | ||

=== Bitcoin Address === | === Bitcoin Address === | ||

A Bitcoin address is an alphanumeric string used to receive bitcoins. Each address is derived from a cryptographic key pair: a private key, which authorizes spending, and a public key, which can be shared to receive funds. Addresses may also encode more complex scripts, such as multisignature conditions, where multiple private keys are required to spend the funds. | A [https://www.techtarget.com/whatis/definition/Bitcoin-address Bitcoin address] is an alphanumeric string used to receive bitcoins. Each address is derived from a cryptographic key pair: a private key, which authorizes spending, and a public key, which can be shared to receive funds. Addresses may also encode more complex scripts, such as multisignature conditions, where multiple private keys are required to spend the funds.<sup>[https://www.bitstack-app.com/en/learn-bitcoin/understanding-bitcoin-addresses?c=EUR 29]</sup> | ||

<small>28 Blockpit, “How Does Bitcoin Work? Blockchain, Network, Transactions”, Achieved, Retrieved May 2025</small> | <small>28 Blockpit, “How Does Bitcoin Work? Blockchain, Network, Transactions”, [https://www.blockpit.io/blog/how-does-bitcoin-work Achieved], Retrieved May 2025</small> | ||

<small>29 Bitstack, “Everything you need to know about Bitcoin addresses",Archived, Retrieved July 2024.</small> | <small>29 Bitstack, “Everything you need to know about Bitcoin addresses",[https://www.bitstack-app.com/en/learn-bitcoin/understanding-bitcoin-addresses?c=EUR Archived], Retrieved July 2024.</small> | ||

| Line 374: | Line 371: | ||

● '''Taproot/BC1P''' addresses offer enhanced privacy for Bitcoin transactions and enable smart contract features. Their transaction size is between that of Legacy and Segwit addresses. Taproot addresses always start with bc1p. | ● '''Taproot/BC1P''' addresses offer enhanced privacy for Bitcoin transactions and enable smart contract features. Their transaction size is between that of Legacy and Segwit addresses. Taproot addresses always start with bc1p. | ||

''For example: bc1prwgcpptoxrpfl5go81wpd5qlsig5yt4g7urb45e. | ''For example: bc1prwgcpptoxrpfl5go81wpd5qlsig5yt4g7urb45e.'''<sup>[https://www.bitpay.com/blog/crypto-wallet-addresses 30]</sup>''''' | ||

Bitcoin addresses are generated from a wallet’s mnemonic seed phrase, which deterministically produces multiple key pairs. The public key or script is hashed and encoded in a standard format, Base58Check for legacy addresses, Bech32 for SegWit, and Bech32m for Taproot to create a human-readable address. Each address also includes a checksum to detect errors during transmission or entry. | Bitcoin addresses are generated from a wallet’s mnemonic seed phrase, which deterministically produces multiple key pairs. The public key or script is hashed and encoded in a standard format, Base58Check for legacy addresses, Bech32 for SegWit, and Bech32m for Taproot to create a human-readable address. Each address also includes a checksum to detect errors during transmission or entry. | ||

deterministic wallets enable users to easily generate new addresses for each transaction while retaining control through the original seed phrase. | deterministic wallets enable users to easily generate new addresses for each transaction while retaining control through the original seed phrase. | ||

Bitcoin addresses are central to the network’s security model: only the holder of the corresponding private key can spend funds associated with an address. Losing a private key results in the permanent loss of access to the bitcoins, while exposing the private key can lead to theft. | Bitcoin addresses are central to the network’s security model: only the holder of the corresponding private key can spend funds associated with an address. Losing a private key results in the permanent loss of access to the bitcoins, while exposing the private key can lead to theft. | ||

<small><sup>28</sup> Bitpay, “Crypto Wallet Addresses: What They Are and How to Create One” [https://www.bitpay.com/blog/crypto-wallet-addresses Achieve], Retrieved, October 2024.</small> | |||

[[File:Screenshot 2025-11-19 120100.png|thumb]] | [[File:Screenshot 2025-11-19 120100.png|thumb]] | ||

=== Bitcoin Transaction === | === Bitcoin Transaction === | ||

In Bitcoin, cryptography is used to secure transactions and prevent double-spending, where electronic coins are represented as chains of digital signatures. Each owner transfers a coin by signing it and giving it to the next owner. This allows anyone to verify ownership. To prevent double-spending, all transactions are publicly announced, and participants agree on the order of transactions using a shared network history. | In Bitcoin, [https://www.fortinet.com/resources/cyberglossary/what-is-cryptography cryptography] is used to secure transactions and prevent double-spending, where electronic coins are represented as chains of digital signatures. Each owner transfers a coin by signing it and giving it to the next owner. This allows anyone to verify ownership. To prevent double-spending, all transactions are publicly announced, and participants agree on the order of transactions using a shared network history. | ||

[[File:Screenshot 2025-11-19 120153.png|thumb]] | [[File:Screenshot 2025-11-19 120153.png|thumb]] | ||

==== Timestamp Server ==== | ==== Timestamp Server ==== | ||

A timestamp server records transactions by hashing them into blocks and linking them in a chain. Each block includes a reference to the previous block, creating a chronological record that cannot be changed without redoing the work of all subsequent blocks. | A [https://www.codegic.com/what-is-cryptographic-timestamp/ timestamp server] records transactions by hashing them into blocks and linking them in a chain. Each block includes a reference to the previous [https://www.analyticsinsight.net/cryptocurrency-analytics-insight/bitcoin-is-getting-too-old-and-slow-to-produce-blocks block], creating a chronological record that cannot be changed without redoing the work of all subsequent blocks.[[File:Screenshot 2025-11-19 120313.png|thumb]] | ||

[[File:Screenshot 2025-11-19 120313.png|thumb]] | |||

==== Proof-of-Work ==== | ==== Proof-of-Work ==== | ||

Bitcoin uses a proof-of-work system where computers solve complex puzzles to create a new block. This process requires significant computing power and ensures that the longest chain represents the majority of honest participants. It also prevents manipulation, as changing a block would require redoing the work of all later blocks. | Bitcoin uses a [https://www.analyticsinsight.net/cryptocurrency-analytics-insight/proof-of-stake-vs-proof-of-work-which-crypto-giant-out-of-ethereum-and-bitcoin-hosts-the-better-consensus proof-of-work system] where computers solve complex puzzles to create a new block. This process requires significant computing power and ensures that the longest chain represents the majority of honest participants. It also prevents manipulation, as changing a block would require redoing the work of all later blocks. | ||

==== Network ==== | ==== Network ==== | ||

| Line 411: | Line 405: | ||

==== Incentives ==== | ==== Incentives ==== | ||

Miners are rewarded with newly created coins and transaction fees for adding blocks to the blockchain. This encourages participants to maintain honesty, as manipulating the system would be less profitable than following the rules. | [https://www.analyticsinsight.net/cryptocurrency-analytics-insight/why-are-bitcoin-miners-turning-to-ai-for-profits Miners] are rewarded with newly created coins and transaction fees for adding blocks to the blockchain. This encourages participants to maintain honesty, as manipulating the system would be less profitable than following the rules. | ||

==== Disk Space ==== | ==== Disk Space ==== | ||

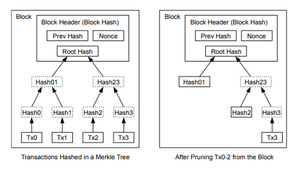

Bitcoin utilizes a Merkle Tree structure to store transactions efficiently, enabling the pruning of old transactions while maintaining compact block headers. This minimizes storage requirements over time. | Bitcoin utilizes a [https://www.geeksforgeeks.org/dsa/introduction-to-merkle-tree/ Merkle Tree structure] to store transactions efficiently, enabling the pruning of old transactions while maintaining compact block headers. This minimizes storage requirements over time. | ||

==== Simplified Payment Verification ==== | ==== Simplified Payment Verification ==== | ||

| Line 424: | Line 418: | ||

==== Security and Attack Resistance ==== | ==== Security and Attack Resistance ==== | ||

An attacker trying to alter transactions would need more computing power than the majority of honest nodes. The probability of success decreases exponentially with each block added after a transaction, making the network secure. | An attacker trying to alter transactions would need more computing power than the majority of honest nodes. The probability of success decreases exponentially with each block added after a transaction, making the network secure. | ||

<small><sup>30</sup> Bitcoin.Org “Bitcoin: A Peer-to-Peer Electronic Cash System, Nakamoto, Satosh”, [https://bitcoin.org/bitcoin.pdf Achieved], Retrieved October 2008.</small> | |||

== Privacy and fungibility == | == Privacy and fungibility == | ||

Bitcoin is pseudonymous, meaning funds are linked to addresses rather than real identities. Every transaction is publicly recorded on the blockchain, so patterns like spending from multiple addresses can reveal connections between users. | [https://buybitcoinworldwide.com/anonymity/ Bitcoin is pseudonymous], meaning funds are linked to addresses rather than real identities. Every transaction is publicly recorded on the blockchain, so patterns like spending from multiple addresses can reveal connections between users. | ||

Unsafe habits, such as address reuse, weaken privacy, while exchanges may also collect personal data for legal reasons. Users can enhance their privacy by generating new addresses for each transaction or utilizing tools like CoinJoin and the Lightning Network to conceal transaction details. | Unsafe habits, such as address reuse, weaken privacy, while exchanges may also collect personal data for legal reasons. Users can enhance their privacy by generating new addresses for each transaction or utilizing tools like [https://www.investopedia.com/terms/c/coinjoin.asp CoinJoin] and the Lightning Network to conceal transaction details. | ||

Fungibility means that each bitcoin should be equal and interchangeable with every other bitcoin. While the network treats all bitcoins equally, the blockchain records their history, which allows users or exchanges to reject coins from suspicious or stolen sources. | [https://www.religareonline.com/blog/what-is-fungibility/ Fungibility] means that each bitcoin should be equal and interchangeable with every other bitcoin. While the network treats all bitcoins equally, the blockchain records their history, which allows users or exchanges to reject coins from suspicious or stolen sources. | ||

Privacy-enhancing solutions, such as confidential transactions, help protect both transaction amounts and ownership links, improving fungibility. Decentralized mining and future scalability improvements further support fairness and privacy in the network. | Privacy-enhancing solutions, such as confidential transactions, help protect both transaction amounts and ownership links, improving fungibility. Decentralized [https://www.analyticsinsight.net/cryptocurrency-analytics-insight/top-10-biggest-bitcoin-mining-companies-by-market-cap-in-2025 mining] and future scalability improvements further support fairness and privacy in the network.<sup>[https://www.politesi.polimi.it/retrieve/a81cb05d-0807-616b-e053-1605fe0a889a/Thesis_Alessandro_Miola_12_2018.pdf 32]</sup> | ||

== Wallets == | == Wallets == | ||

Bitcoin wallets are software or hardware tools that allow users to store, send, and receive bitcoins by managing the private keys required to access the blockchain. The first Bitcoin wallet program, often referred to as the Satoshi client, was released in 2009 by Nakamoto as open-source software. Bitcoin Core is one of the most widely used wallet clients, with forks like Bitcoin Unlimited also available. | [https://www.analyticsinsight.net/bitcoin/best-desktop-wallets-for-bitcoin-in-2025-secure-user-friendly-picks Bitcoin wallets] are software or hardware tools that allow users to store, send, and receive bitcoins by managing the private keys required to access the blockchain. The first Bitcoin wallet program, often referred to as the [https://medium.com/@3.0University/the-satoshi-client-49d819913f3d Satoshi client], was released in 2009 by Nakamoto as open-source software. [https://bitcoin.org/en/bitcoin-core/ Bitcoin Core] is one of the most widely used wallet clients, with forks like Bitcoin Unlimited also available. | ||

Wallets can be hot or cold. [https://www.analyticsinsight.net/cryptocurrency-analytics-insight/the-leading-crypto-hot-wallets-of-2024-a-comparative-review Hot wallets] are connected to the internet and include apps or online services, enabling easy transactions but exposing users to hacking risks. [https://www.analyticsinsight.net/cryptocurrency-analytics-insight/hot-and-cold-storage-top-crypto-wallets-of-2024 Cold wallets] store private keys offline, using devices like [https://www.ledger.com/ Ledger] or [https://trezor.io/ Trezor], or paper/metal backups, offering higher security for long-term storage.<sup>[https://medium.com/the-bitcoin-beacon/bitcoin-wallets-101-what-you-need-to-know-4984cb93c6b2 33]</sup> | |||

Wallets can be hot or cold. Hot wallets are connected to the internet and include apps or online services, enabling easy transactions but exposing users to hacking risks. Cold wallets store private keys offline, using devices like Ledger or Trezor, or paper/metal backups, offering higher security for long-term storage. | |||

Wallets provide a public address for receiving Bitcoin, while the private key or seed phrase is required to authorize transactions. Beginners often start with hot wallets for small amounts and later use cold wallets for larger holdings. Using both types can strike a balance between convenience and security. | Wallets provide a public address for receiving Bitcoin, while the private key or seed phrase is required to authorize transactions. Beginners often start with hot wallets for small amounts and later use cold wallets for larger holdings. Using both types can strike a balance between convenience and security. | ||

Security practices include safeguarding seed phrases, avoiding phishing scams, and testing wallets with small amounts before larger transfers. Proper wallet management ensures users retain full control over their Bitcoin holdings rather than leaving them on exchanges. | Security practices include safeguarding seed phrases, avoiding phishing scams, and testing wallets with small amounts before larger transfers. Proper wallet management ensures users retain full control over their Bitcoin holdings rather than leaving them on exchanges. | ||

<small><sup>32</sup> School of Industrial and Information Engineering, “ Addressing Privacy and Fungibility Issues in Bitcoin: Confidential Transactions”, [https://www.politesi.polimi.it/retrieve/a81cb05d-0807-616b-e053-1605fe0a889a/Thesis_Alessandro_Miola_12_2018.pdf Achieved], Retrieved 2017-2018referred to as</small> | |||

== Scalability Challenges == | == Scalability Challenges == | ||

Bitcoin faces scalability issues due to its limited block size of 1 MB and a block creation time of approximately 10 minutes, restricting transactions to 3–7 per second. As network usage increases, it leads to delays and higher fees. Bitcoin can scale through layer 2 solutions and sidechains without altering its core protocol. | Bitcoin faces scalability issues due to its limited block size of 1 MB and a block creation time of approximately 10 minutes, [https://www.analyticsinsight.net/bitcoin/how-bitcoins-challenges-affect-the-crypto-world restricting transactions] to 3–7 per second. As network usage increases, it leads to delays and higher fees. Bitcoin can scale through layer 2 solutions and sidechains without altering its core protocol. | ||

Prominent examples include the Lightning Network for fast micropayments, Stacks for smart contracts, RSK for EVM-compatible sidechains, and the Liquid Network for quicker transactions with lower fees. | Prominent examples include the Lightning Network for fast micropayments, Stacks for smart contracts, RSK for EVM-compatible sidechains, and the [https://trustmachines.co/learn/what-is-liquid-network/ Liquid Network] for quicker transactions with lower fees. | ||

While increasing block size or reducing block time could compromise security and decentralization, layered approaches improve efficiency, programmability, and cost. Scalability remains a work in progress, balancing speed, security, and decentralization, with the Lightning Network widely used to facilitate practical Bitcoin transactions. | While increasing block size or reducing block time could compromise security and decentralization, layered approaches improve efficiency, programmability, and cost. Scalability remains a work in progress, balancing speed, security, and decentralization, with the Lightning Network widely used to facilitate practical Bitcoin transactions.<sup>[https://www.geeksforgeeks.org/computer-networks/bitcoin-scalability-problem/ 34]</sup> | ||

<sup>33</sup> Medium, “'''Bitcoin Wallets 101: What You Need to Know'''” Achieved, Retrieved April 2025 | <sup>33</sup> Medium, “'''Bitcoin Wallets 101: What You Need to Know'''” [https://medium.com/the-bitcoin-beacon/bitcoin-wallets-101-what-you-need-to-know-4984cb93c6b2 Achieved], Retrieved April 2025 | ||

<sup>34</sup> GeeksforGeeks, “'''Bitcoin Scalability Problem'''” Achieved, Retrieved, July 2025. | <sup>34</sup> GeeksforGeeks, “'''Bitcoin Scalability Problem'''” [https://www.geeksforgeeks.org/computer-networks/bitcoin-scalability-problem/ Achieved], Retrieved, July 2025. | ||

== Economics and usage == | == Economics and usage == | ||

=== Bitcoin's Theoretical Roots and Ideology === | === Bitcoin's Theoretical Roots and Ideology === | ||

Bitcoin’s creation drew on earlier digital currency experiments, such as DigiCash, e-gold, B-Money, Hashcash, and Bit Gold, which explored cryptography, proof-of-work, and secure electronic transactions. The blockchain, Bitcoin’s core innovation, ensures trustless, peer-to-peer transactions without intermediaries, embodying both Hayek’s vision and the cypherpunks’ emphasis on privacy. | Bitcoin’s creation drew on earlier digital currency experiments, such as DigiCash, e-gold, B-Money, Hashcash, and Bit Gold, which explored cryptography, proof-of-work, and secure electronic transactions. The blockchain, Bitcoin’s core innovation, ensures trustless, [https://www.analyticsinsight.net/tech-news/best-10-peer-to-peer-lending-platforms-to-explore-in-2025 peer-to-peer] transactions without intermediaries, embodying both Hayek’s vision and the cypherpunks’ emphasis on privacy. | ||

Launched in 2009 by Satoshi Nakamoto, Bitcoin represents a revolutionary financial system combining individual autonomy, cryptographic security, and decentralization, reshaping the global approach to money and digital value. | Launched in 2009 by Satoshi Nakamoto, Bitcoin represents a revolutionary financial system combining individual autonomy, cryptographic security, and decentralization, reshaping the global approach to money and digital value.<sup>[https://medium.com/coinmonks/bitcoin-and-its-philosophical-roots-exploring-the-ideologies-and-historical-predecessors-of-c9536e76c298 35]</sup> | ||

=== Recognition as a Currency and Legal Status === | === Recognition as a Currency and Legal Status === | ||

Bitcoin’s legal status varies widely across the globe. While it debuted in 2009 as a decentralized digital currency, nations continue debating its regulation due to concerns about fraud, money laundering, and financial stability. | Bitcoin’s legal status varies widely across the globe. While it debuted in 2009 as a decentralized digital currency, nations continue debating its regulation due to concerns about fraud, money laundering, and financial stability. | ||

Countries like the U.S., U.K., Canada, Australia, and most EU nations recognize Bitcoin legally, often regulating it under anti-money laundering and taxation laws. These regulations cover exchanges, custodial platforms, and reporting requirements, ensuring that users and businesses comply with financial oversight while facilitating the adoption of cryptocurrency. | Countries like the U.S., U.K., Canada, Australia, and most EU nations recognize Bitcoin legally, often regulating it under [https://www.investopedia.com/terms/a/aml.asp anti-money laundering] and taxation laws. These regulations cover exchanges, custodial platforms, and reporting requirements, ensuring that users and businesses comply with financial oversight while facilitating the adoption of cryptocurrency. | ||

Conversely, several nations have banned Bitcoin entirely. China, Pakistan, Saudi Arabia, Bolivia, and Tunisia prohibit its use due to its decentralized nature, volatility, and potential for illicit activities. In such regions, financial systems are restricted from supporting Bitcoin transactions. | Conversely, several nations have banned Bitcoin entirely. China, Pakistan, Saudi Arabia, Bolivia, and Tunisia prohibit its use due to its decentralized nature, volatility, and potential for illicit activities. In such regions, financial systems are restricted from supporting Bitcoin transactions. | ||

| Line 472: | Line 468: | ||

As global adoption grows, regulations continue evolving. Governments are gradually integrating cryptocurrencies into legal frameworks, balancing innovation with consumer | As global adoption grows, regulations continue evolving. Governments are gradually integrating cryptocurrencies into legal frameworks, balancing innovation with consumer | ||

<sup> | protection, financial stability, and tax compliance, while debates around central bank digital currencies and regulatory harmonization remain ongoing.<sup>[https://www.investopedia.com/articles/forex/041515/countries-where-bitcoin-legal-illegal.asp#:~:text=Bitcoin's%20debut%20in%202009%20initiated,international%20laws%20that%20regulate%20Bitcoin. 36]</sup> | ||

<small><sup>35</sup> Medium, “Bitcoin and Its Philosophical Roots: Exploring the Ideologies and Historical Predecessors of Digital Money”, [https://medium.com/coinmonks/bitcoin-and-its-philosophical-roots-exploring-the-ideologies-and-historical-predecessors-of-c9536e76c298 Achieved], Retrieved May 2023</small> | |||

== Use for payments == | == Use for payments == | ||

On August 21, 2025, Harvard economist Kenneth Rogoff reflected on his 2018 prediction that Bitcoin would crash to $100, admitting he underestimated BTC’s role in the underground economy and overestimated regulators’ ability to curb its growth. Additionally, it states that Bitcoin is rarely used in regular transactions with merchants, but is popular in the informal economy and for illicit activities. | On August 21, 2025, Harvard economist [https://rogoff.scholars.harvard.edu/ Kenneth Rogoff] reflected on his 2018 prediction that Bitcoin would crash to $100, admitting he underestimated BTC’s role in the underground economy and overestimated regulators’ ability to curb its growth. <sup>[https://www.coindesk.com/markets/2025/08/21/harvard-professor-who-predicted-bitcoin-crash-to-usd100-says-regulators-were-too-lax 37]</sup>Additionally, it states that Bitcoin is rarely used in regular transactions with merchants, but is popular in the informal economy and for illicit activities. | ||

The European Union recognizes Bitcoin as a crypto-asset, regulated under MiCA between June and December 2024. Similarly, Canada and Australia tax Bitcoin as a financial asset and require exchanges to comply with AML/CFT laws, ensuring transparency and consumer protection. | The [https://www.britannica.com/topic/European-Union European Union] recognizes Bitcoin as a crypto-asset, regulated under [https://www.esma.europa.eu/esmas-activities/digital-finance-and-innovation/markets-crypto-assets-regulation-mica MiCA] between June and December 2024. Similarly, Canada and Australia tax Bitcoin as a financial asset and require exchanges to comply with [https://www.imf.org/en/topics/financial-integrity/amlcft AML/CFT laws], ensuring transparency and consumer protection. | ||

In the United States, Bitcoin has been classified as property for taxation since 2013, and exchanges are treated as money services businesses under the Bank Secrecy Act. In June 2024, the Treasury and IRS finalized regulations standardizing digital asset reporting and defining token classifications for tax purposes. | In the United States, Bitcoin has been classified as property for taxation since 2013, and exchanges are treated as money services businesses under the Bank Secrecy Act. In June 2024, the Treasury and [https://www.irs.gov/ IRS] finalized regulations standardizing digital asset reporting and defining token classifications for tax purposes.<sup>[https://www.investopedia.com/articles/forex/041515/countries-where-bitcoin-legal-illegal.asp 38]</sup> | ||

Commonly cited reasons for not using bitcoin are irreversible, lack legal protections, have volatile value, and investors must beware of scams and fraud. In June 2023, The Conversation, new data shows Bitcoin is rarely used for payments, acting more like gambling. Its price volatility, limited adoption, and speculative nature make it a risky store of value rather than a practical currency. | Commonly cited reasons for not using bitcoin are irreversible, lack legal protections, have volatile value, and investors must beware of scams and fraud.<sup>[https://portal.ct.gov/dob/consumer/consumer-education/cryptocurrency-risks 39]</sup> In June 2023, [https://theconversation.com/global The Conversation], new data shows Bitcoin is rarely used for payments, acting more like gambling. Its price volatility, limited adoption, and speculative nature make it a risky store of value rather than a practical currency.<sup>[https://theconversation.com/almost-no-one-uses-bitcoin-as-currency-new-data-proves-its-actually-more-like-gambling-207909 40]</sup> | ||

<sup> | In October 2023, a survey conducted by [https://block.xyz/ Block], the technology company founded by [https://www.analyticsinsight.net/biography/jack-dorsey Jack Dorsey], found that 87% of Bitcoin holders regularly send or receive cross-border remittances. The survey, which included 6,600 adults across 15 countries, also reported that 56.2% of respondents expressed optimism about Bitcoin, emphasizing its appeal as a cost-effective and efficient means for international money transfers.<sup>[https://www.businesstoday.in/latest/corporate/story/87-bitcoin-holders-regularly-send-or-receive-cross-border-remittances-survey-400875-2023-10-05 41]</sup> | ||

< | In April 2022, the [https://www.worldbank.org/en/country/centralafricanrepublic/overview Central African Republic (CAR)] adopted bitcoin as legal tender alongside the CFA franc.<sup>42</sup> Still, in 2023, the Central African Republic’s parliament repealed legislation that gave bitcoin and other cryptocurrencies legal tender status. A new law amends an April 2022 statute that proved controversial among the CAR’s partners in the [https://ecfr.eu/special/african-cooperation/cemac/ Economic and Monetary Community of Central Africa.]<sup>[https://www.centralbanking.com/central-banks/currency/digital-currencies/7956294/car-to-drop-crypto-as-legal-tender 43]</sup> | ||

On September 7, 2021, El Salvador officially made Bitcoin legal tender, purchasing 400 bitcoins (approximately $21 million) and later another 150 bitcoins, totaling 550 bitcoins (approximately $26 million). The move aimed to boost foreign investment, reduce remittance costs (with expected annual savings of $170–400 million), and create jobs. However, the rollout faced technical glitches with the Chivo wallet, and the Bitcoin price dropped from $52,000 to $43,050. | |||

The decision sparked controversy, as most Salvadorans protested, citing unfamiliarity with cryptocurrency. A [https://www.unipage.net/en/4400/central_american_university Central American University] survey found that only 4.8% understood Bitcoin. Experts, including Fitch Group, warned that legalizing Bitcoin could increase money laundering risks, cyber threats, and financial volatility.<sup>[https://www.merklescience.com/blog/bitcoin-becomes-legal-tender-in-el-salvador-spurs-money-laundering-concerns 44]</sup> | |||

Bitcoin, launched in 2009, is a decentralized cryptocurrency whose legal status varies across countries. Many developed nations, including the U.S., Canada, and the U.K., allow its use under regulatory frameworks, whereas countries such as China, Saudi Arabia, Pakistan, Tunisia, and Bolivia have banned it due to concerns about volatility, financial stability, and illicit activities. | |||

<sup><small>36</small></sup> <small>Investopedia, “Bitcoin Legality Worldwide: Legal and Illegal Countries List” [https://www.investopedia.com/articles/forex/041515/countries-where-bitcoin-legal-illegal.asp#:~:text=Bitcoin's%20debut%20in%202009%20initiated,international%20laws%20that%20regulate%20Bitcoin. Achieved], Retrieved October 2025.</small> | |||

<small><sup>37</sup>Coindesk, “Harvard Professor Who Predicted Bitcoin Crash to $100 Says Regulators Were Too Lax” [https://www.coindesk.com/markets/2025/08/21/harvard-professor-who-predicted-bitcoin-crash-to-usd100-says-regulators-were-too-lax Achieved], Retrieved August 2025</small> | |||

<small><sup>38</sup> Investopedia, “Bitcoin Legality Worldwide: Legal and Illegal Countries List” [https://www.investopedia.com/articles/forex/041515/countries-where-bitcoin-legal-illegal.asp Achieved], Retrieved, October 2025</small> | |||

<small><sup>39</sup> US Connecticut HALF, “State of Connecticut Department of Banking”, [https://portal.ct.gov/dob/consumer/consumer-education/cryptocurrency-risks Achieved], Retrieved 2025 ''' '''</small> | |||

Bitcoin, | <small><sup>40</sup> The Conversation, “ '''Almost no one uses Bitcoin as currency, new data proves. It’s actually more like gambling'''” [https://theconversation.com/almost-no-one-uses-bitcoin-as-currency-new-data-proves-its-actually-more-like-gambling-207909 Achieved], Retrieved June 2023</small> | ||

<small><sup>41</sup> Business Today, “Survey by Jack Dorsey - Adoption of Bitcoin’’, Achieved, Retrieved October 2023</small> | <small><sup>41</sup> Business Today, “Survey by Jack Dorsey - Adoption of Bitcoin’’, [https://www.businesstoday.in/latest/corporate/story/87-bitcoin-holders-regularly-send-or-receive-cross-border-remittances-survey-400875-2023-10-05 Achieved], Retrieved October 2023</small> | ||

<small><sup>42</sup> BBC, “Bitcoin becomes official currency in Central African Republic” Achieved, Retrieved April 2022</small> | <small><sup>42</sup> BBC, “Bitcoin becomes official currency in Central African Republic” [https://www.bbc.com/news/world-africa-61248809 Achieved], Retrieved April 2022</small> | ||

<small><sup>43</sup> Central Banking, “CAR to drop crypto as legal tender”, Achieved, Retrieved March 2023</small> | <small><sup>43</sup> Central Banking, “CAR to drop crypto as legal tender”, [https://www.centralbanking.com/central-banks/currency/digital-currencies/7956294/car-to-drop-crypto-as-legal-tender Achieved], Retrieved March 2023</small> | ||

<small><sup>44</sup> Merkle Science, “Bitcoin Becomes Legal Tender in El Salvador; Spurs Money Laundering Concerns” Achieved, Retrieved September 2021</small> | <small><sup>44</sup> Merkle Science, “Bitcoin Becomes Legal Tender in El Salvador; Spurs Money Laundering Concerns” [https://www.merklescience.com/blog/bitcoin-becomes-legal-tender-in-el-salvador-spurs-money-laundering-concerns Achieved], Retrieved September 2021</small> | ||

== Use for Investment == | == Use for Investment == | ||

The period from 2020 to 2026 was marked by significant institutional adoption, regulatory milestones, and volatile market performance for cryptocurrencies, particularly Bitcoin. | The period from 2020 to 2026 was marked by significant institutional adoption, regulatory milestones, and volatile market performance for cryptocurrencies, particularly Bitcoin. | ||

On November 12, 2025, author Robert Kiyosaki reignited debates about the global financial system by stating on his X account, "I'm buying, not selling," projecting a Bitcoin price target of $250,000 by 2026, alongside estimates of $27,000 for gold and $100 for silver. | On November 12, 2025, author [https://blockchainreporter.net/net-worth/robert-kiyosaki/ Robert Kiyosaki] reignited debates about the global financial system by stating on his X account, "I'm buying, not selling," projecting a Bitcoin price target of $250,000 by 2026, alongside estimates of $27,000 for gold and $100 for silver.<sup>[https://news.bit2me.com/en/robert-kiyosaki-reafirma-confianza-en-bitcoin 45]</sup> | ||

The following month, in October 2025, SpaceX, led by Elon Musk, transferred 1,215 Bitcoin worth $133.7 million to multiple new wallets, sparking market speculation. | The following month, in October 2025, [https://www.spacex.com/ SpaceX], led by [https://www.analyticsinsight.net/biography/elon-musk Elon Musk], transferred 1,215 Bitcoin worth $133.7 million to multiple new wallets, sparking market speculation.<sup>[https://news.bit2me.com/en/robert-kiyosaki-reafirma-confianza-en-bitcoin 46]</sup> | ||

The broader market in 2025 saw the total crypto market cap cross the $4 trillion threshold for the first time, with the number of crypto mobile wallet users reaching all-time highs, up 20% from the previous year. Bitcoin itself hit an all-time high above $126,000. | The broader market in 2025 saw the total crypto market cap cross the $4 trillion threshold for the first time, with the number of crypto mobile wallet users reaching all-time highs, up 20% from the previous year. Bitcoin itself hit an all-time high above $126,000.<sup>[https://a16zcrypto.com/posts/article/state-of-crypto-report-2025/ 47]</sup> | ||

BlackRock's iShares Bitcoin Trust (IBIT) was cited in 2025 as the most traded Bitcoin exchange-traded product launch of all time. | [https://www.blackrock.com/us/individual/products/333011/ishares-bitcoin-trust-etf/ BlackRock's iShares Bitcoin Trust (IBIT)] was cited in 2025 as the most traded Bitcoin exchange-traded product launch of all time. | ||

In September 2025, El Salvador's National Bitcoin Office announced it would divide its $682 million Bitcoin reserve, comprising over 7,000 BTC, into multiple wallets, each holding up to 500 BTC to strengthen security. This move built upon the country's historic 2021 adoption of Bitcoin as legal tender. El Salvador made history in 2021 by becoming the first country to adopt Bitcoin as legal tender. | In September 2025, El Salvador's National Bitcoin Office announced it would divide its $682 million Bitcoin reserve, comprising over 7,000 BTC, into multiple wallets, each holding up to 500 BTC to strengthen security. This move built upon the country's historic 2021 adoption of Bitcoin as legal tender. <sup>[https://crystalintelligence.com/news/el-salvador-revamps-bitcoin-storage-plan/ 48]</sup> El Salvador made history in 2021 by becoming the first country to adopt Bitcoin as legal tender. | ||

A key regulatory milestone occurred on January 10, 2024, when the U.S. Securities and Exchange Commission (SEC) approved spot Bitcoin exchange-traded funds (ETFs), a move described as crypto going "mainstream." | A key regulatory milestone occurred on January 10, 2024, when the [https://www.sec.gov/ U.S. Securities and Exchange Commission (SEC)] approved spot Bitcoin exchange-traded funds (ETFs), a move described as crypto going "mainstream." <sup>[https://www.chainalysis.com/blog/spot-bitcoin-etfs/ 49]</sup> In between 2024 and 2025, Bitcoin accounted for | ||

<sup> | over $1.2 trillion in fiat inflows, roughly 70% more than [https://www.analyticsinsight.net/bitcoin/bitcoin-vs-ethereum-in-2025-regulation-liquidity-and-growth-in-focus Ethereum], which saw approximately $724 billion in volume.<sup>[https://www.chainalysis.com/blog/2025-global-crypto-adoption-index/ 50]</sup> | ||

<sup> | A 2024 survey from the [https://www.pewresearch.org/ Pew Research Center] found that 17% of American adults have invested in, traded, or used a cryptocurrency.<sup>[https://www.pewresearch.org/short-reads/2024/10/24/majority-of-americans-arent-confident-in-the-safety-and-reliability-of-cryptocurrency/ 51]</sup> | ||

<sup> | Furthermore, a 2025 Institutional Investor Digital Assets Survey indicated that nearly 50% of asset managers were considering launching crypto funds in the next 2 years, focusing on Bitcoin and Ethereum ETPs.<sup>[https://www.ey.com/content/dam/ey-unified-site/ey-com/en-us/insights/financial-services/documents/ey-growing-enthusiasm-propels-digital-assets-into-the-mainstream.pdf 52]</sup> | ||

Significant corporate holdings were accumulated during this period. As of 2024, MicroStrategy held over 150,000 BTC, positioning it as the publicly traded company with the most important Bitcoin holdings globally. As of 2024, the [https://etfs.grayscale.com/gbtc Grayscale Bitcoin Trust (GBTC)] held over 600,000 BTC, making it one of the world's largest Bitcoin custodians. | |||

<sup> | In early 2021, [https://www.tesla.com/ Tesla] announced a $1.5 billion investment in Bitcoin, a landmark move for a Fortune 500 company. Block, Inc. was also a prominent holder, making an initial investment of $50 million in Bitcoin in 2020, followed by another $170 million in 2021.<sup>[https://bitcoindepot.com/bitcoin-atm-info/companies-organizations-that-hold-bitcoin/ 53]</sup> | ||

<small><sup>45</sup> Bit2Me, “Robert Kiyosaki reaffirms his confidence in Bitcoin: “I’m buying, not selling”, [https://news.bit2me.com/en/robert-kiyosaki-reafirma-confianza-en-bitcoin Achieved], Retrieved November 2025</small> | |||

<small><sup>46</sup> Yahoo Finance, “Elon Musk's SpaceX Shakes Up Bitcoin Market With $133 Million Transfer”, [https://finance.yahoo.com/news/elon-musks-spacex-shakes-bitcoin-191617879.html Achieved], Retrieved October 2025.</small> | |||

<small><sup>47</sup> A16zcrypto, “State of Crypto 2025: The year crypto went mainstream” [https://a16zcrypto.com/posts/article/state-of-crypto-report-2025/ Achieved], Retrieved October 2025</small> | |||

<small><sup>48</sup> Crystal Intelligence, “El Salvador splits Bitcoin reserve to boost security”, [https://crystalintelligence.com/news/el-salvador-revamps-bitcoin-storage-plan/ Achieved], Retrieved September 2025</small> | |||

<small><sup>49</sup> Chainalysis, “Spot Bitcoin ETFs: Everything You Need To Know”, [https://www.chainalysis.com/blog/spot-bitcoin-etfs/ Achieved], Retrieved, August 2024</small> | |||

== Status as an economic bubble == | == Status as an economic bubble == | ||

Bitcoin, along with other cryptocurrencies, has been described as an economic bubble by several economists, including Nobel Prize-winning economist Jean Tirole, Former IMF Chief Economist Kenneth Rogoff, Nobel Prize-winning economist Joseph Stiglitz, New York University economist Nouriel Roubini, and others. | Bitcoin, along with other cryptocurrencies, has been described as an economic bubble by several economists, including Nobel Prize-winning economist [https://www.britannica.com/money/Jean-Tirole Jean Tirole], Former IMF Chief Economist [https://rogoff.scholars.harvard.edu/ Kenneth Rogoff], Nobel Prize-winning economist [https://live.worldbank.org/en/experts/j/joseph-stiglitz Joseph Stiglitz], New York University economist [https://www.stern.nyu.edu/faculty/bio/nouriel-roubini Nouriel Roubini], and others. | ||

Nobel Prize-winning economist Jean Tirole warned that weak oversight of stablecoins could trigger government bailouts worth billions if reserves fail. He cautioned that investor panic and lost confidence might collapse their pegs to traditional assets in September 2025. | Nobel Prize-winning economist Jean Tirole warned that weak oversight of [https://www.analyticsinsight.net/white-papers/what-are-stablecoins-a-beginners-guide stablecoins] could trigger government bailouts worth billions if reserves fail. He cautioned that investor panic and lost confidence might collapse their pegs to traditional assets in September 2025.<sup>[https://finance.yahoo.com/news/nobel-prize-winning-economist-warns-071726755.html 54]</sup> | ||

Former IMF Chief Economist Kenneth Rogoff warned that Bitcoin is undermining U.S. dollar dominance in the $25 trillion shadow economy. He stated that crypto-driven flows are reducing dollar demand in developing nations and indirectly raising U.S. interest rates.<sup>[https://news.bitcoin.com/former-imf-bitcoin-dollar-role-shadow-economy/ 55]</sup> | |||

On December 4, 2024, [https://www.federalreservehistory.org/people/jerome-h-powell Jerome Powell,] Chair of the U.S. Federal Reserve, stated that Bitcoin is a rival to gold rather than the U.S. dollar. Speaking at The New York Times DealBook Summit, Powell said, ''"People use bitcoin as a speculative asset… It’s just like gold – only it’s virtual, it’s digital. It’s not a competitor for the dollar. It’s really a competitor for gold."[https://www.centralbanking.com/fintech/crypto-assets/7963449/bitcoin-is-a-rival-to-gold-not-the-dollar-powell#:~:text=The%20chair%20of%20the%20US,a%20competitor%20for%20the%20dollar. 56]'' | |||

On July 11, 2018, Nobel Prize-winning economist Joseph Stiglitz warned that Bitcoin could fail due to its vulnerability to money laundering and fraud as governments confront these issues. He stated, "You cannot have a means of payment that is based on secrecy- no government can allow that." He predicted that authorities would eventually "use the hammer" if Bitcoin grew too large. | |||

[https://www.nyu.edu/ New York University] economist Nouriel Roubini criticized Bitcoin’s viability, emphasizing its instability as a means of payment. He remarked, "Bitcoin is not even accepted at bitcoin conferences, and how can something that falls 20% one day and then rises 20% the next be a stable store of value?" He also criticized Bitcoin on [https://x.com/ Twitter], calling it neither a currency nor a store of value. He labeled it a [https://www.investor.gov/protect-your-investments/fraud/types-fraud/ponzi-scheme Ponzi scheme], citing volatility, minimal transaction activity, and connections to criminal activities.<sup>[https://www.mining.com/roubini-unleashes-twitter-attack-on-bitcoin-96864/ 57]</sup> | |||

Former IMF chief economist Kenneth Rogoff highlighted Bitcoin’s anonymity as a key risk. He cautioned that regulatory action would limit its use, stating, "Bitcoin could easily be worth just $100 in 10 years. People in power will move to regulate anonymous transactions."<sup>[https://www.investopedia.com/news/three-leading-economists-come-out-against-bitcoin/ 58]</sup> | |||

<small><sup>50</sup> Chainalysis, “The 2025 Global Adoption Index: India and the United States Lead Cryptocurrency Adoption” [https://www.chainalysis.com/blog/2025-global-crypto-adoption-index/ Achieved], Retrieved September 2025</small> | |||

<small><sup>51</sup> Pew Research Center, “Majority of Americans aren’t confident in the safety and reliability of cryptocurrency”, [https://www.pewresearch.org/short-reads/2024/10/24/majority-of-americans-arent-confident-in-the-safety-and-reliability-of-cryptocurrency/ Achieved], Retrieved October 2024</small> | |||

<small><sup>52</sup> EY and Coinbase, “2025 Institutional Investor

Digital Assets Survey” [https://www.ey.com/content/dam/ey-unified-site/ey-com/en-us/insights/financial-services/documents/ey-growing-enthusiasm-propels-digital-assets-into-the-mainstream.pdf Achieved], Retrieved 2025</small> | |||

<small><sup>53</sup> Bitcoin Depot, “Companies/Organizations that Hold Bitcoin”, [https://bitcoindepot.com/bitcoin-atm-info/companies-organizations-that-hold-bitcoin/ Achieved], Retrieved September 2024.</small> | |||

<small><sup>54</sup> Yahoo Finance, “Nobel Prize-Winning Economist Warns Governments May Pay Billions If Stablecoins Collapse”, [https://finance.yahoo.com/news/nobel-prize-winning-economist-warns-071726755.html Achieved], Retrieved September 2025</small> | |||

<small><sup>55</sup> Bitcoin.Com News, “ Former IMF Chief Economist: Bitcoin Undermines Dollar Hegemony in $25 Trillion Shadow Economy” Achieved</small> | <small><sup>55</sup> Bitcoin.Com News, “ Former IMF Chief Economist: Bitcoin Undermines Dollar Hegemony in $25 Trillion Shadow Economy” [https://news.bitcoin.com/former-imf-bitcoin-dollar-role-shadow-economy/ Achieved]</small> | ||

<small><sup>56</sup> Central Banking, “Bitcoin is a rival to gold, not the dollar – Powell” Achieved, Retrieved December 2024</small> | <small><sup>56</sup> Central Banking, “Bitcoin is a rival to gold, not the dollar – Powell” [https://www.centralbanking.com/fintech/crypto-assets/7963449/bitcoin-is-a-rival-to-gold-not-the-dollar-powell#:~:text=The%20chair%20of%20the%20US,a%20competitor%20for%20the%20dollar. Achieved], Retrieved December 2024</small> | ||

<small><sup>57</sup> The Northern Miner Group, “Roubini unleashes Twitter attack on Bitcoin”, Achieved, Retrieved March 2014</small> | <small><sup>57</sup> The Northern Miner Group, “Roubini unleashes Twitter attack on Bitcoin”, [https://www.mining.com/roubini-unleashes-twitter-attack-on-bitcoin-96864/ Achieved], Retrieved March 2014</small> | ||

<small><sup>58</sup> Investopedia, “Three Leading Economists Come Out Against Bitcoin” Archived, Retrieved July 2018</small> | <small><sup>58</sup> Investopedia, “Three Leading Economists Come Out Against Bitcoin” [https://www.investopedia.com/news/three-leading-economists-come-out-against-bitcoin/ Archived], Retrieved July 2018</small> | ||

= Market characteristics = | = Market characteristics = | ||

| Line 586: | Line 581: | ||

Unlike traditional financial markets, Bitcoin trading occurs 24/7 and is highly volatile, with prices often fluctuating rapidly. Transactions are transparent and immutable, recorded on public blockchains, enhancing security and trust. | Unlike traditional financial markets, Bitcoin trading occurs 24/7 and is highly volatile, with prices often fluctuating rapidly. Transactions are transparent and immutable, recorded on public blockchains, enhancing security and trust. | ||

The market covers a diverse range of assets, including payment coins, utility tokens, stablecoins, and DeFi tokens. Its innovation-driven nature fosters new financial applications, including smart contracts, decentralized finance, and digital ownership, creating a dynamic ecosystem that continues to evolve. | The market covers a diverse range of assets, including payment coins, utility tokens, stablecoins, and DeFi tokens. Its innovation-driven nature fosters new financial applications, including smart contracts, decentralized finance, and digital ownership, creating a dynamic ecosystem that continues to evolve.<sup>[https://www.markets.com/education-centre/crypto-market-analysis-what-are-the-features-of-cryptocurrency 59]</sup> | ||

__NOTOC__ | |||

Latest revision as of 10:56, 19 November 2025

| Bitcoin | |

|---|---|

| |

| Commonly used logo of bitcoin | |

| Denominations | |

| Plural | Bitcoins |

| Symbol | ₿ (Unicode: U+20BF ₿ BITCOIN SIGN) |

| Code | BTC |

| Precision | 10⁻⁸ |

| Subunits |

59 Markets.com, “Crypto market analysis: What are the features of cryptocurrency?” Archived. Retrieved October 2025 |

| Development | |

| Original author | Satoshi Nakamoto |

| White paper | Bitcoin: A Peer-to-Peer Electronic Cash System |

| Implementation | Bitcoin Core |

| Initial release | 0.1.0 / 9 January 2009 (16 years ago) |

| Latest release | 30.0.0 / 11 October 2025 (34 days ago) |

| Code repository | GitHub |

| Development status | Active |

| Written in | C++ |

| Source model | Free and Open Source Software |

| License | MIT Licence |

| Ledger | |

| Ledger start | 3 January 2009 (16 years ago) |

| Timestamping scheme | Proof of work (partial hash inversion) |

| Hash function | SHA-256 (two rounds) |

| Issuance | Decentralized (block reward), Initially ₿50 per block, halved every 210,000 blocks |

| Block reward | ₿3.125 (as of 2025) |

| Block time | 10 minutes |

| Circulating supply | ₿19,934,271 (as of 14 October 2025) |

| Supply limit | ₿21,000,000 |

| Valuation | |

| Exchange rate | Floating |

| Website | bitcoin.org |